Imagine this scenario: you’re driving down the highway, enjoying your road trip when suddenly your car breaks down. You’re stranded on the side of the road with no idea what to do next. Enter State Farm Towing – a lifesaver in times of automotive crisis. In this blog post, we’ll delve into how State Farm Towing works and explore all of your options for getting back on the road quickly and safely. Whether you’re a loyal State Farm customer or just curious about their services. Read on to learn everything you need to know about State Farm Towing.

Introduction to State Farm Towing

State Farm is a well-known and trusted insurance company that offers various services to its customers, one of which is towing. When your car breaks down or gets into an accident, the last thing you want to worry about is how to get it towed. This is where State Farm’s towing service comes in.

State Farm offers 24/7 emergency roadside assistance for its policyholders, including towing services. This means that if you find yourself stranded on the side of the road with a non-drivable vehicle. You can call State Farm and they will dispatch a tow truck to assist you.

How Does State Farm Towing Work?

State Farm has a network of pre-screened and approved towing companies across the country that they work with. When you call for their towing service, they will send out the nearest available tow truck from their network to your location.

Once the tow truck arrives, they will assess the situation and determine the best way to transport your vehicle. In most cases, this will be by flatbed tow truck, which ensures that your car remains safe and secure during transportation.

You do not need any additional coverage or add-ons to access State Farm’s towing service; it is automatically included in your auto insurance policy. However, there are some limitations and restrictions on when and how many times you can use this service within a certain time frame.

What Are Your Options?

State Farm offers two types of towing options – Basic and Extended Towing Coverage. The Basic option covers up to $100 per disablement for each covered vehicle on your policy within a 72-hour period. The Extended option provides additional benefits such as no mileage limitations and coverage for trailers or vehicles being used outside of North America.

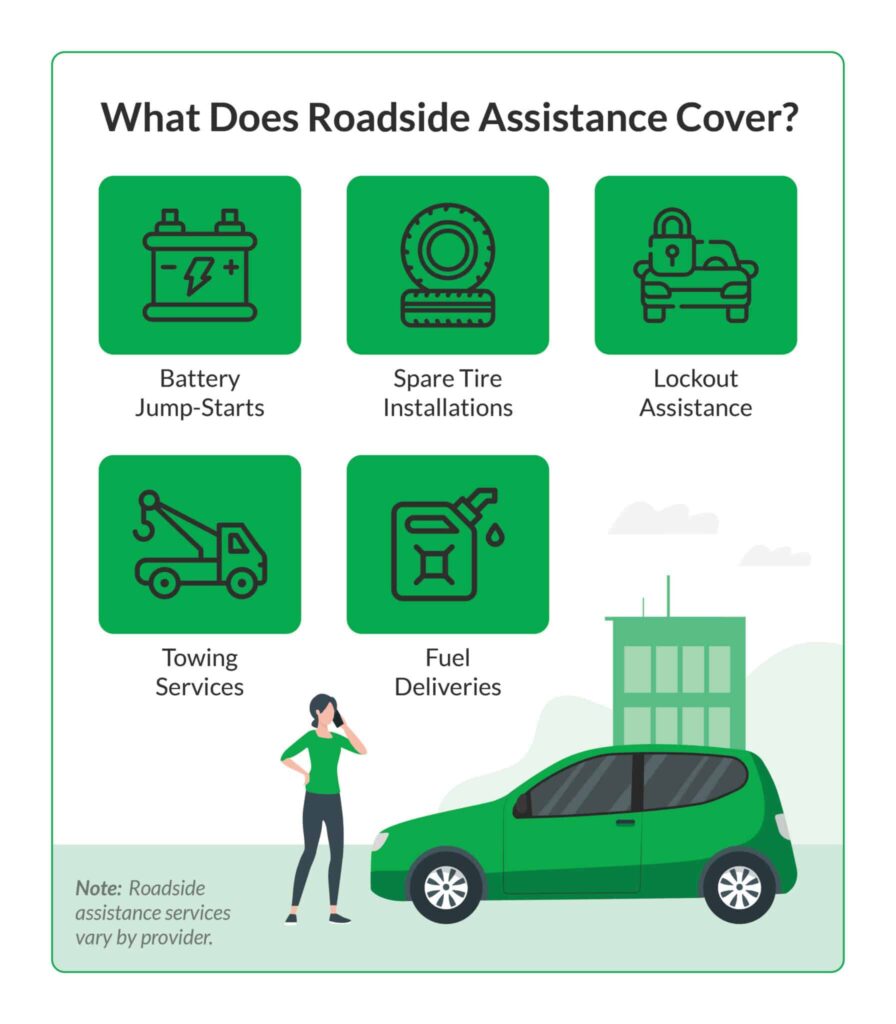

In addition to these options, State Farm also offers Emergency Road Service (ERS) coverage as an add-on to your insurance policy. ERS includes all the benefits of Basic Towing Coverage, as well as jump-starts, tire changes, and lockout services.

Conclusion

State Farm’s towing service is a reliable and convenient option for policyholders who find themselves in need of emergency roadside assistance. With their extensive network of pre-approved towing companies and various coverage options. You can rest assured that your vehicle will be safely transported to a repair shop or preferred location. So the next time you experience car trouble on the road. Remember that State Farm has got you covered with their dependable towing service.

Benefits of Having State Farm Towing Coverage

Having State Farm towing coverage can provide numerous benefits and peace of mind for drivers. Here are some of the top reasons why having this type of coverage is beneficial:

1. Emergency Towing Services: One of the main benefits of State Farm towing coverage is access to emergency towing services. In case your car breaks down on the side of the road, you can call their 24/7 roadside assistance hotline and they will arrange for a tow truck to come to your location. This service can save you from being stranded and potentially facing expensive towing fees.

2. Cost Savings: With insurance coverage, you may only have to pay a small deductible or no fee at all for towing services, depending on your policy. This can save you from paying hundreds of dollars out-of-pocket for unexpected breakdowns or accidents.

3. Wide Coverage Area: State Farm has an extensive network of contracted tow truck companies across the country, so no matter where you are traveling within the United States, chances are there will be a nearby tow truck available through your State Farm policy.

4.Worry-Free Road Trips: Knowing that you have reliable and affordable emergency towing services through State Farm can give you peace of mind when going on long road trips or driving in unfamiliar areas.

5.Emergency Assistance Beyond Towing: In addition to towing services, State Farm offers other forms of roadside assistance such as lockout service, fuel delivery, jump-starts and flat tire changes. These additional services can be extremely helpful in case of emergencies while on the road.

6.Customizable Coverage Options: State Farm allows customers to customize their auto insurance policies according to their needs and budget. This means that if you do not drive frequently or live in an area with minimal risk for breakdowns, then you may opt for lower levels of coverage which could result in reduced premiums.

7.Added Convenience: Having all your auto insurance needs including towing coverage under one provider like State Farm can provide convenience and streamline the claims process in case of an accident or breakdown.

Having State Farm towing coverage offers numerous benefits such as emergency services, cost savings, wide coverage area, worry-free road trips, additional roadside assistance options, customizable coverage options and added convenience. It is a worthwhile investment for any driver to consider for their auto insurance policy.

How Does State Farm Towing Work?

State Farm is a reputable insurance company that offers a range of services to its customers, including towing assistance. If you find yourself stranded on the side of the road due to a car breakdown or accident, State Farm’s towing service can come to your rescue. But how exactly does State Farm towing work? In this section, we will delve into the details of how this service operates and what options are available for policyholders.

Firstly, it is important to note that State Farm offers two types of towing coverage: Emergency Road Service (ERS) and Towing and Labor Coverage (TLC). The main difference between these two options is that ERS is only available for vehicles insured under a comprehensive or collision policy, while TLC can be added as an optional coverage to any auto policy.

Now let’s explore how each type of coverage works in case you need towing assistance. With ERS, you can call a 24/7 hotline specifically designated for roadside emergencies. A trained representative will assist you in dispatching a tow truck from one of their preferred providers to your location. This service covers up to $100 per disablement and includes services such as jump-starts, tire changes, fuel delivery, and lockout assistance.

On the other hand, TLC allows you to choose your preferred tow company when faced with an emergency situation. You can call State Farm’s Claims Center at any time for help with locating an appropriate tow provider near you. Just like with ERS, the cost of towing will be covered up to $100 per disablement.

In addition to these basic towing options, there are also some add-ons available from State Farm that can enhance your experience in case of a breakdown or accident. One popular option is Trip Interruption Coverage which provides reimbursements for lodging expenses if you are stranded more than 50 miles away from home due to a covered loss.

It is worth noting that both ERS and TLC have limits on the number of times you can use them per year. ERS allows up to five service calls per membership year, while TLC has a limit of two service calls per policy period. However, if you need more than the allowed number of services, State Farm provides an option to upgrade your coverage for an additional fee.

State Farm’s towing service is designed to provide quick and efficient assistance in case of roadside emergencies. Whether you have ERS or TLC, you can count on their network of trusted tow providers to get you back on the road safely. And with optional add-ons like Trip Interruption Coverage, you can have peace of mind knowing that State Farm has got your back whenever unexpected car troubles arise.

Eligible Vehicles and Types of Services Covered

State Farm offers a comprehensive towing service that covers a wide range of eligible vehicles and types of services. As one of the leading insurance providers in the United States, State Farm understands the importance of providing reliable roadside assistance to its customers. Whether you are stranded on the side of the road due to a mechanical breakdown or involved in an accident, State Farm’s towing service is there to assist you.

Eligible Vehicles

State Farm’s towing service covers a variety of vehicles including cars, trucks, SUVs, motorcycles, and vans. This means that whether you have a compact car or a large RV, you can rest assured that State Farm has got you covered. Additionally, their towing service also extends to rental cars as well as trailers attached to your vehicle.

Types of Services Covered

When it comes to roadside assistance and towing services, State Farm offers coverage for both emergency and non-emergency situations. Some of the common scenarios where their towing service can come in handy include:

1. Mechanical Breakdown: If your vehicle breaks down due to a mechanical issue such as engine failure or transmission problems, State Farm’s towing service will tow your vehicle to the nearest repair shop.

2. Flat Tire: Getting a flat tire is not only inconvenient but can also be dangerous if you are unable to change it on your own. In such cases, State Farm’s towing service can provide assistance by sending someone out to change your tire or tow your vehicle if necessary.

3. Dead Battery: A dead battery can leave you stranded wherever you are without warning. However, with State Farm’s roadside assistance program, all it takes is one phone call and they will send someone out to give your battery a jumpstart or replace it if needed.

4. Lockout Service: It happens to everyone – locking yourself out of your own car. With State Farm’s towing service, help is just a call away. They will send someone out who has the necessary tools to unlock your car and get you back on the road.

In addition to these services, State Farm also offers coverage for services such as fuel delivery, extrication (if your vehicle is stuck or stranded), and towing to a preferred repair shop. It’s important to note that the extent of coverage may vary depending on your specific insurance policy, so it’s always best to check with your agent for details.

State Farm’s towing service covers a wide range of eligible vehicles and provides assistance in various emergency and non-emergency situations. Knowing that you have reliable roadside assistance available can give you peace of mind while traveling. So next time you encounter any issues with your vehicle on the road, remember that State Farm has got you covered!

How to Request a Tow

If you find yourself in a situation where your vehicle needs to be towed, the process can seem overwhelming and confusing. However, with State Farm Towing, requesting a tow is simple and stress-free. Here are the steps to follow when requesting a tow through State Farm.

1. Contact State Farm: The first step is to contact your local State Farm agent or call their toll-free number at 1-800-STATE-FARM (1-800-782-8332). You will need to have your policy number ready when you make the call.

2. Provide necessary information: When speaking with a representative from State Farm, be sure to provide them with all the necessary information about your vehicle and its current location. This includes the make and model of your car, your location, and any other relevant details that may help expedite the process.

3. Request for roadside assistance: If you have roadside assistance coverage included in your insurance policy with State Farm, this is the time to request it. Roadside assistance can cover services such as towing, battery jump-starts, flat tire changes, and lockout services.

4. Choose a preferred towing option: Once you have requested roadside assistance, you will be given different options for towing services available in your area through State Farm’s network of trusted providers. You can choose from basic towing or additional options such as flatbed towing or covered transportation if needed.

5. Verify payment options: Before confirming the tow service, make sure to ask about payment options. In most cases, if you have roadside assistance coverage included in your policy, there will be no out-of-pocket costs for basic towing services within a certain distance limit.

6. Confirm details and wait for arrival: Make sure to confirm all the details of the tow service before hanging up with the State Farm representative. They will provide an estimated time of arrival for the tow truck so that you know what to expect.

7. Additional assistance: If your vehicle needs to be taken to a repair shop, State Farm can also provide you with tow-to-repair services. This means that your car will be towed directly to a State Farm-approved repair shop where they can assist you with the claims process and any necessary repairs.

Requesting a tow through State Farm is a simple and straightforward process. By following these steps, you can rest assured that your vehicle will be safely towed to its destination with minimal hassle on your end. Remember to always keep your insurance policy number handy and make sure you have roadside assistance coverage for added peace of mind in case of emergencies.

Response Time and Availability

State Farm prides itself on its efficient response time and widespread availability for all your towing needs. Whether you find yourself stranded on the side of the road or in need of a tow from your own driveway, State Farm has got you covered.

When it comes to response time, State Farm is dedicated to providing prompt assistance to their customers. With a network of over 40,000 independent contracted towing professionals across the country, they strive to have someone at your location within 45 minutes of your call. This quick response time means that you won’t be left waiting for hours on end for help to arrive.

But what about availability? Will State Farm be able to assist you no matter where you are? The answer is yes! State Farm’s towing services are available 24/7, 365 days a year, including holidays. So whether it’s midnight on New Year’s Eve or early morning on Christmas Day, if you’re in need of a tow, State Farm will be there for you.

Not only does State Farm offer round-the-clock service, but they also cover a wide range of locations. Their network covers all 50 states as well as Canada and Puerto Rico. This means that no matter where life takes you, whether it’s on a road trip or moving across the country, State Farm will still be able to provide reliable and efficient roadside assistance.

In addition to their extensive coverage area and prompt response times, State Farm also offers various options for their towing services. Depending on your specific needs and situation, they have different types of tow trucks such as flatbeds and wheel lifts available to ensure that your vehicle is transported safely and securely. They also offer options like winching service if your car is stuck in mud or snow.

Furthermore, with their On Your Side® Claims Service guarantee, customers can rest assured that they will receive top-notch service from start to finish when using State Farm’s towing services. This guarantee promises that their team of professionals will handle your claim efficiently and effectively, making the process as stress-free as possible.

When it comes to response time and availability for towing services, State Farm has proven to be a reliable and trustworthy option. With their extensive network, 24/7 availability, various tow truck options, and On Your Side® guarantee, you can feel confident in choosing State Farm for all your towing needs.

Understanding Your Options with State Farm Towing Coverage

As a State Farm policyholder, you have the option to add towing coverage to your auto insurance policy. This coverage can come in handy when you find yourself stranded on the side of the road due to a mechanical breakdown or accident. But before adding this coverage, it’s important to understand what exactly it entails and how it works.

What Does State Farm Towing Coverage Include?

State Farm offers two types of towing coverage: Basic Emergency Road Service (ERS) and Emergency Road Service Plus (ERS+). The basic ERS covers up to $50 for towing services and up to $100 for emergency roadside assistance such as changing a flat tire or jump-starting a dead battery. On the other hand, ERS+ offers higher limits of up to $100 for towing and up to $150 for roadside assistance. It also includes additional benefits like rental vehicle reimbursement if your car needs more than eight hours of repairs at an approved repair facility.

How Does State Farm Towing Coverage Work?

If you have an eligible claim under your policy, such as an accident or mechanical breakdown, you can request roadside assistance by calling State Farm’s 24/7 toll-free number. A service provider will be dispatched to assist you based on your location and needs. You can also choose your own service provider but may need prior approval from State Farm for reimbursement.

It’s important to note that towing coverage only applies when necessary repairs cannot be made at the location where the vehicle becomes disabled or if it is unsafe to do so. Additionally, towing must be done by a licensed professional who follows all state laws and regulations.

What Are Your Options When Using Towing Coverage?

When using towing coverage, you have several options depending on your situation:

1. To The Nearest Repair Facility: If possible, your vehicle will be towed directly to a nearby repair shop that is within 15 miles from your breakdown location.

2. To A Repair Facility of Your Choice: If you have a trusted repair shop, you can request your vehicle to be towed there instead of the nearest one recommended by the service provider.

3. Return Home: If your car breaks down while traveling and is within 50 miles from your home, State Farm may cover the cost of towing it back to your residence.

4. Decline Towing Assistance: You also have the option to decline towing assistance if you have a different means of getting your vehicle to a repair facility.

Having towing coverage with State Farm can provide peace of mind knowing that help is just a phone call away in case of an emergency. Make sure to review and understand your policy’s details and options before adding this coverage or using it in a time of need.

Different Levels of Coverage

When it comes to State Farm towing services, there are several levels of coverage that you can choose from based on your needs and budget. These levels range from basic roadside assistance to comprehensive towing and labor coverage.

1. Basic Roadside Assistance: This is the most basic level of coverage offered by State Farm for towing services. It includes emergency roadside assistance such as jump starts, flat tire changes, lockout services, and fuel delivery. This option is ideal for those who only need occasional assistance on the road and want a more affordable option.

2. Towing Coverage: This level of coverage includes everything in basic roadside assistance. But also adds tow truck service if your vehicle cannot be repaired on the spot. You can choose either a specific dollar amount or an unlimited number of tows per year depending on your preference and budget.

3. Towing and Labor Coverage: This option provides all the benefits of towing coverage but also includes labor costs associated with minor repairs. For example, if your car breaks down on the side of the road and needs a quick fix like a battery change or belt replacement. This coverage will cover the cost of labor in addition to the tow truck service.

4. Comprehensive Towing and Labor Coverage: As the name suggests, this is the most comprehensive level of coverage offered by State Farm for towing services. In addition to all the benefits mentioned above. It also covers larger repairs that cannot be done immediately on-site such as transmission issues or engine problems. This option may be more expensive than others but provides peace of mind knowing that you have complete protection in case of any unexpected breakdowns.

It’s important to note that some states have different regulations for insurance policies.So not all levels of coverage may be available in every state. Additionally, certain vehicles may not qualify for certain levels due to age or mileage restrictions.

When it comes to choosing a level of State Farm towing coverage, it’s essential to assess your needs and budget to determine the best option for you. Whether you opt for basic roadside assistance or comprehensive towing and labor coverage. State Farm has options to fit your specific needs and keep you covered on the road.

State Farm Towing: How Does It Work and What Are Your Options?

Additional Services Offered

Aside from the standard towing services, State Farm also offers a range of additional services to assist their policyholders in times of need. These additional services are designed to provide even more convenience and support for drivers who encounter unexpected car troubles on the road.

1. Roadside Assistance

One of the most useful additional services offered by State Farm is their roadside assistance program. This service covers a wide range of vehicle-related emergencies such as flat tires, dead batteries, and lockouts. In case any of these situations occur while you’re on the road, simply call State Farm’s 24/7 hotline and they will dispatch a professional technician to your location to provide assistance.

2. Emergency Fuel Delivery

Running out of gas can be frustrating and inconvenient, especially when you’re far from a gas station. Fortunately, with State Farm’s emergency fuel delivery service, you can have up to two gallons of fuel delivered directly to your location so you can reach the nearest gas station safely.

3. Winching Service

If your vehicle gets stuck in mud, snow or other tough terrains, State Farm has got you covered with their winching service. A trained operator will be sent out to your location with specialized equipment to safely pull your vehicle out of any sticky situation.

4. Locksmith Services

Locking yourself out of your car can happen at any time and it can be quite stressful when it does. But with State Farm’s locksmith services, help is just a phone call away! They will send a qualified locksmith to your location to help you get back into your vehicle without causing any damage.

5. Trip Interruption Coverage

In case you experience an accident or breakdown while traveling over 100 miles from home, State Farm offers trip interruption coverage that provides reimbursement for expenses such as lodging and transportation while your vehicle is being repaired.

State Farm’s additional services go above and beyond to provide their policyholders with the utmost convenience and support during unexpected car troubles. With these extra options, you can have peace of mind knowing that State Farm has your back whenever you need assistance on the road.

Tips for Making the Most Out of Your State Farm Towing Coverage

State Farm offers reliable and affordable towing coverage for its customers, giving them peace of mind on the road. However, simply having this coverage is not enough; it is important to know how to make the most out of it. In this section, we will discuss some tips to help you get the most out of your State Farm towing coverage.

1. Familiarize Yourself with Your Policy

Before hitting the road, make sure you have a clear understanding of what your State Farm towing policy covers. This includes knowing the maximum number of miles for each tow, any additional fees or restrictions. Which types of vehicles are covered under your policy. By being well-informed about your policy details, you can avoid any surprises when you need to use your towing coverage.

2. Keep Your Contact Information Updated

In case of an emergency or breakdown on the road. It is crucial that State Farm has your current contact information on file. This ensures that they can reach you promptly and dispatch assistance as soon as possible. Make sure to update your contact information whenever there are changes such as a new phone number or address.

3. Know Who to Call in Case of a Towing Emergency

When faced with a roadside emergency, it can be overwhelming trying to figure out who to call for assistance. Save yourself time and stress by having State Farm’s roadside assistance number handy at all times: 1-877-627-5757. This direct line connects you directly with their team of professionals who can assist with arranging towing services.

4. Use the Mobile App for Quick Assistance

State Farm also offers a mobile app that allows you to request roadside assistance directly from your smartphone without having to make any calls or wait on hold. The app uses GPS technology to pinpoint your location and sends help right away.

5. Take Advantage of Additional Services

Besides basic towing services, State Farm offers other helpful services such as battery jump-starts, lockout assistance, and fuel delivery. These services are included in your towing coverage and can be a lifesaver in case of an emergency.

By following these tips, you can maximize the benefits of your State Farm towing coverage and have peace of mind on the road. Remember to always prioritize safety and use caution when facing a roadside emergency. With State Farm’s reliable towing coverage and these helpful tips. You can rest assured that help is just a call or click away whenever you need it.

Maintaining Your Vehicle

Maintaining your vehicle is crucial for its longevity and overall performance. Regular maintenance can also prevent breakdowns and save you from costly repairs. Here are some important tips for maintaining your vehicle:

1. Follow the manufacturer’s recommended service schedule: The first step in maintaining your vehicle is to follow the recommended service schedule provided by the manufacturer. This includes regular oil changes, tire rotations, and other routine services.

2. Check fluid levels regularly: Your car’s fluids play a vital role in its proper functioning. Make sure to check the engine oil, transmission fluid, brake fluid, coolant. Power steering fluid regularly and top them off if needed.

3. Keep an eye on tire pressure: Properly inflated tires not only improve fuel efficiency but also ensure safety on the road. Check your tire pressure at least once a month and adjust it according to the manufacturer’s recommendations.

4. Replace air filters when necessary: Clean air filters improve engine performance and fuel efficiency while reducing emissions. Replace them every 12 months or as recommended by the manufacturer.

5. Get regular tune-ups: Tune-ups involve inspecting various parts of your vehicle such as spark plugs, filters, belts, hoses, etc. To ensure that they are working properly. Getting tune-ups at regular intervals can prevent major issues down the line.

6. Pay attention to warning lights: Modern cars come equipped with warning lights that indicate when there is an issue with your vehicle’s systems such as engine temperature or low tire pressure. Ignoring these warnings could lead to more significant problems. Therefore, it is crucial to address them promptly.

7. Wash and wax your car regularly: Keeping your car clean not only makes it look good but also protects it from dirt buildup and corrosion due to salt or other chemicals on roads during winter months.

In addition to these tips, it is essential to listen carefully for any strange noises or vibrations. while driving as they could be signs of underlying issues. If you notice any problems. Tt is best to get them checked by a certified mechanic.

Regular maintenance can go a long way in keeping your vehicle running smoothly. However, even with proper maintenance, breakdowns can still occur. In such situations, having roadside assistance coverage from State Farm Towing can provide peace of mind and save you from additional stress and expenses.